Metals Trading

Home / Metals

Trade Metals CFDs with Pentagon Markets

for our full list of Metals & typical spreads

The global foreign exchange market is one of the fastest, most liquid and exciting markets. Join thousands of traders who are already trading with Pentagon Markets, a multi award-winning global forex broker, offering over 60+ fx pairs in all the major currencies 24 hours a day, 5 days a week. All major currency pairs include the US dollar (USD) as either the base or counter currency. Majors include pairs like the GBP/USD, EUR/USD, and USD/JPY.

Pentagon Markets offers you consistently tight spreads, starting from as low as 0.0 pips. We’ve partnered with leading banking and non-banking financial institutions to ensure a deep liquidity pool, so that you get the best available market prices and ultra-low latency order execution.

What are the benefits of trading Metals?

- Trade on spreads from 0.0 pips

- Leverage options up to 500:1

- 60+ currency pairs

- The Forex markets are open 24 hours a day, 5 days a week

- Award winning multilingual customer support

- No price manipulation, no requotes and no dealing desk

- Benefit from low margin, low-cost trading

- High speed trade execution from Equinix servers

- Enter and exit trades whenever you want to, 24/5

- Trade in any direction you think the markets will go, short or long, maximising trading opportunities.

- Get access to pre-open price action and gauge market direction with cutting-edge tools.

What is the Best Platform to Trade Metals?

Metatrader 4. The world’s most popular trading platform.

Discover the benefits of Forex trading on one of the most powerful trading platforms available, MetaTrader 4 (MT4). Available across desktop and mobile platforms the Metatrader 4 platform is ready when you are.

- Spreads from 0.0 pips & leverage up to 500:1

- Customisable interface, including colours of technical indicators

- One-click trading

- MarketWatch

- Live price streaming on Live accounts and Demo accounts 128-bits encryption for secure trading

- Expert Advisors (EAs)

- Customisable alerts

- Compatible with iOS, Android and Mac devices

Are there more platform options?

6 Reasons to Choose Pentagon Markets

A Global Forex broker

Globally

Segregated client funds

& global

Tighter Spreads

Market leading spreads from

0.0 pips, 24/5

Faster Execution

Low latency

execution under 40ms*

Advanced Platforms

MT4, MT5 & Webtrader

with superior client portal

24/7^ Multilingual Customer Support

Award winning support &

personal account managers

Established in 2005

15 years

trading experience

What is Metals Trading?

At Pentagon Markets, we offer you exposure to the most popular precious metals that make up an important commodity asset class. Metals trading is closely linked to the outlook for the overall global markets and major currencies and metals are traded against major currencies in a similar way to other currency pairs on the platform.

Factors affecting precious metal prices include supply and demand, interest rates, economic uncertainty, industrial output and the strength of the dollar with precious metals like gold traditionally viewed as a safe haven in times of volatility. Traders can trade metals to express their outlook on certain industries or to hedge their trading portfolio.

Through careful analysis, CFD traders predict the potential direction of metals prices and attempt to capture gains based on price fluctuations in the short-term or long-term. The market is open 24 hours a day, 5 days a week.

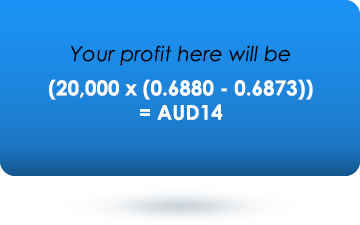

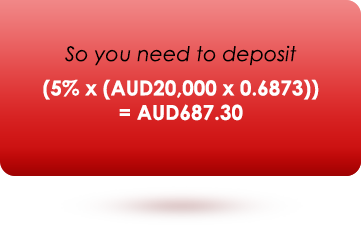

An Example of Leveraged CFD Trading

Suppose you want to trade CFDs, where the underlying asset is the XAUUSD a Metal, also known as Gold vs US Dollar. Let us suppose that the XAUUSD is trading at:

In this case, the price of gold moved in your favor. But, had the price declined instead, moving against your prediction, you could have made a loss. This continuous evaluation of price movements and resultant profit/loss happens daily. Accordingly, it leads to a net return (positive/negative) on your initial margin. In the loss scenario where your free equity, (account balance+ Profit/Loss) falls below the margin requirements (200), the broker will issue a margin call. If you fail to deposit the money, and the market moves further against you, when your free equity reaches the 50% of your initial margin the contract will be closed at the current market price, known as “stop out.”

| If the price of XAUUSD | To | You could Gain or Lose for a Long Position | Resulting in a Return of the Initial Margin |

|---|---|---|---|

| Rises by 1% | 1807.90/1808 | USD 1790 | 20% |

| Declines by 1% | 1772.10/1772.20 | -USD 1790 | -20% |

Metal Spreads

| Symbol | Product | Standard A/c Avg | Raw ECN A/c Min | Avg |

|---|---|---|---|---|

| XAUUSD | Gold vs US Dollar | 0.34 | 0 | 0.16 |

| XAUAUD | Gold vs Australian Dollar | 0.75 | 0.06 | 0.59 |

| XAUEUR | Gold vs Euro | 0.45 | 0.27 | 0.19 |

| XAGUSD | Silver vs US Dollar | 0.024 | 0 | 0.014 |

| XAGAUD | Silver vs Australian Dollar | 0.06 | 0.026 | 0.05 |

Why Trade Precious Metals with Pentagon Markets?

Precious metals are among the Top Commodities To Trade Metals are classified as a hard commodity as they are mined from the earth or extracted from natural resources. Through Contracts For Difference (CFDs), you can gain exposure to metals markets in a unique way that provides a wide range of advantages.

- Margin Trading: As CFDs are a leveraged product, you can open large positions by depositing only the margin required. As metals such as gold have high levels of liquidity, commodities trading offers higher levels of leverage than many other tradable instruments.

- Go 'Long' or 'Short': One of the main attractions of CFDs is the ability to speculate in both rising and falling prices. The ability to open short positions and benefit from falling prices is a unique aspect of CFD trading and one that creates additional trading opportunities.

- Risk Management: Advanced trading platforms such as MetaTrader 4 and MetaTrader 5 offer excellent risk management tools. Their features include a large range of charting tools but also a multitude of order types and alerts to ensure that you are made aware of any changes to market conditions.

Factors Affecting Precious

Metal Prices

Supply and Demand: Applicable across all products and services, the same also applies to precious metals. A shortage in metals or the increased demand for their use can affect prices. Let’s take industrial metals such as copper or aluminium. A technological advancement may create an alternative for their use and decrease their value.

Macroeconomic Variables: Data relating to interest rates and GDP affect a significant amount of metals. One of the reasons is because metals are seen as a safe-haven, and an alternative investment to the cash rate provided by financial institutions.

Market Conditions: Pentagon Markets provides metals trading against many major currencies including the US dollar, similar to foreign exchange. Metals tend to be susceptible to the US dollar and have historically traded in the opposite direction to the greenback. This is why they are often used as part of a hedging strategy in times of economic uncertainty.

Inflation: Anything that dilutes the value of a currency helps the performance of metals. Quantitative easing or the printing of additional money causes a rise in inflation with metal prices generally following suit.

Benefits of Trading Precious Metals

Metals CFDs: As you do not have to not actually own the underlying asset when trading CFDs, there are fewer costs associated with investing in metals this way. There is no need to store the asset and traders can benefit in both rising and falling prices. The prices are comparable to those found on the London Metal Exchange (LME), the world’s largest market for ETFs on base metals and other metals.

Portfolio Diversification: With limited correlation to other financial instruments such as stocks and bonds, trading precious metals is a useful way to diversify your portfolio.

Hedging: Precious metals are often used as part of a risk management strategy. Investors often trade metals to hedge against inflation and currency.

Safe-Haven: During times of economic uncertainty, the value of precious metals tends to rise. This has historically been the case during economic slumps and key political events including major elections.

Metals Trading - FAQ

Some of the factors to consider prior to investing in precious metals include the current geopolitical situation, that state of the US dollar, the position of central banks and inflation rates.

To get a better understanding of this asset class, read our guide on Investing In Precious Metals.

As indicated by their name, precious metals are indeed that. They are rare which prevents the prospect of excessive supply and have an infinite lifespan as they do not rust. The fact that they are measured in troy ounces makes it easy to compare their value.

The History Of Metals dates back thousands of years. Apart from being a medium of trade and exchange, precious metals have been considered as a long-term store of value for an extended period of time.

With respect to Metals CFDs, Gold is the most traded commodity. Platinum, palladium and silver are among the other most traded metals. They can all be traded with Pentagon Markets. Find out more about Investment Strategies For Metals.

Trade the markets with Pentagon Markets

- Metatrader 4 (MT4),Webtrader and Mobile Apps

- Real-Time Tracking with Advanced Client Portal

- Superior VPS Solutions for EAs, Scalpers & Auto Trading

- News & economic calendar

By supplying your email you agree to Pentagon Markets privacy policy and receive future marketing materials from Pentagon Markets. You can unsubscribe at any time.